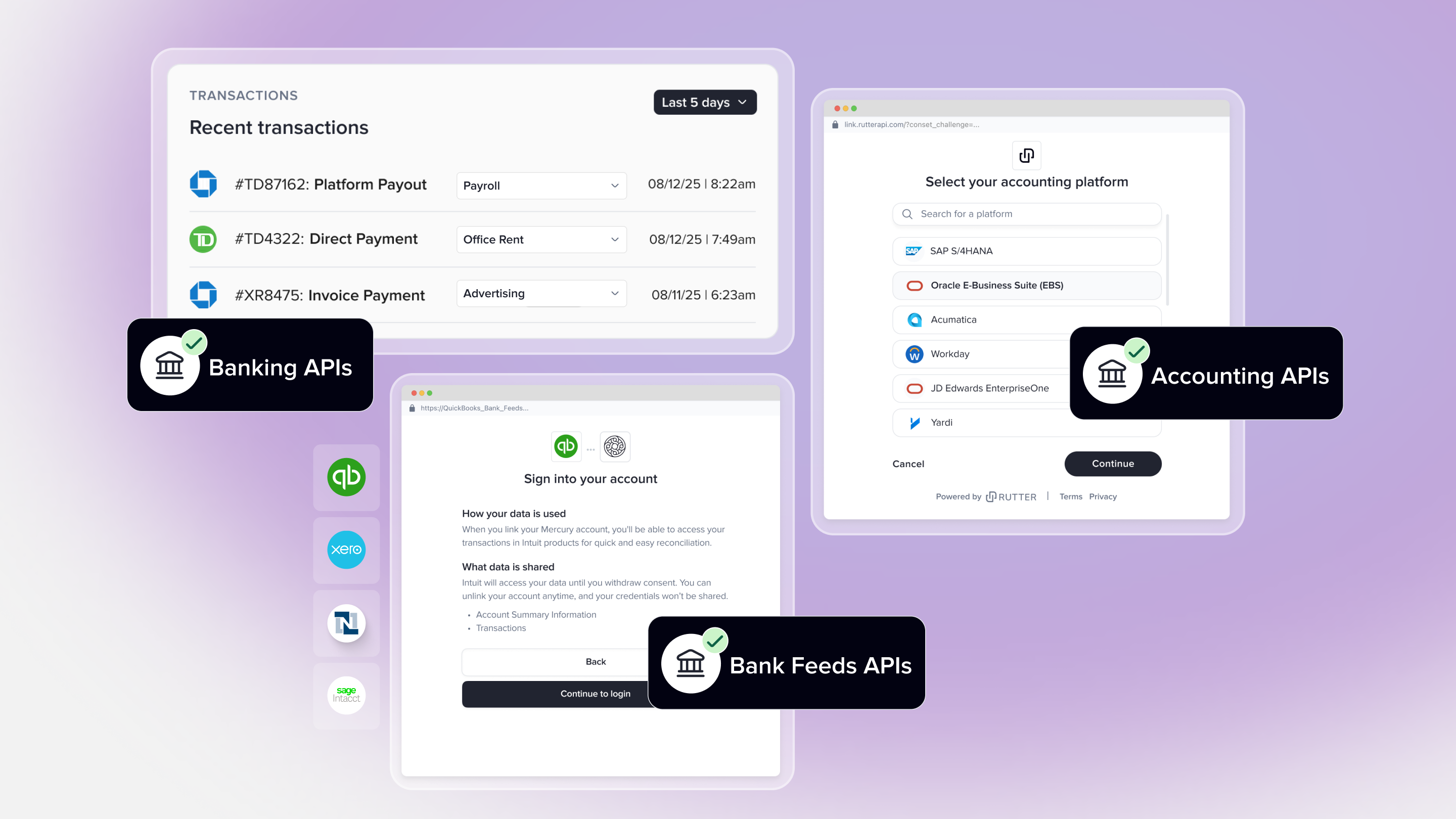

Rutter is thrilled to announce an expansion of our Bank Feeds product with a QuickBooks integration to streamline how you can help your customers upload bank transactions to their preferred accounting platform.

What is Bank Feeds, and where does this fit in? Why automated bank feeds are the new industry standard

Traditionally, accountants manually compared and adjusted records to ensure a company’s cash balance matched the bank statement balances at the end of each month. This is known as reconciliation, and this process, while necessary for accurate financial records and compliance, can be time-consuming and prone to error.

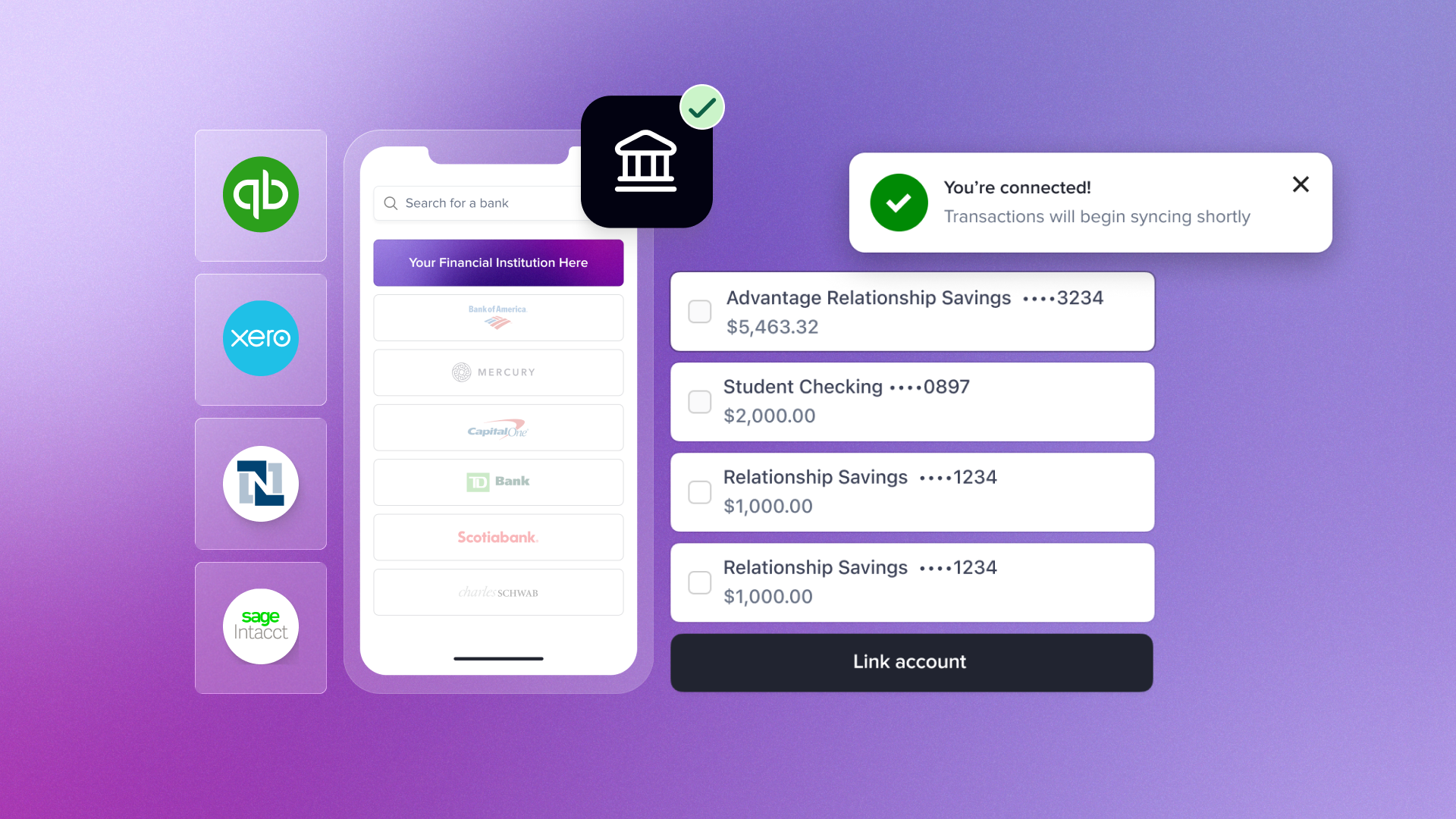

That’s where Bank Feeds comes in, transforming how businesses handle their finances. Bank Feeds sync bank account and credit card transactions directly to accounting platforms, automating the identification of matches. This automation saves time and reduces the risk of costly mistakes—crucial for small and medium-sized businesses (SMBs) with limited resources. By eliminating manual data entry, Bank Feeds helps companies maintain accurate financial records effortlessly, freeing them up to focus on growth and meeting customer demands.

The Problem: Integrating Bank Feeds with major accounting platforms is challenging

Streamlined. Efficient. Integrated.

This is what SMBs demand most from their fintech platforms. More specifically, they seek a solution to migrate banking transactions to their accounting system without a headache. However, building these integrated solutions for your SMB customers can be challenging.

For neo banks/corporate card providers:

1. Major accounting systems like QuickBooks or Sage only allow companies they’ve partnered with to access their Bank Feeds API. Forming these partnerships takes a significant investment of time and resources, and is out of reach for all but the largest fintechs and banks.

2. It takes a considerable amount of time to build these integrations, plus the ability to navigate complex technical requirements that vary significantly by platform. This requires finite resources like trained personnel and dev hours, and forming an in-depth knowledge of each platform API’s specific nuances.

The Solution: Rutter’s QuickBooks Bank Feed can get integrations live in record time

To combat this challenge, Rutter is thrilled to announce the latest addition to our Bank Feeds product: QuickBooks.

With Rutter’s Bank Feeds, banks and fintechs can create seamless integrations for uploading banking data to the accounting platforms their customers rely on most. QuickBooks joins NetSuite, Sage Business Cloud, and Sage Intacct as a platform available for Rutter customers to build bank feed integrations. Here are the best parts:

- Automatic synchronization ensures accuracy and reliable financial records, reducing errors and discrepancies.

- Seamless integration leads to faster and more precise financial reconciliation, streamlining processes, and improving overall financial management.

- User experience, productivity, and efficiency are enhanced, leading to better business outcomes.

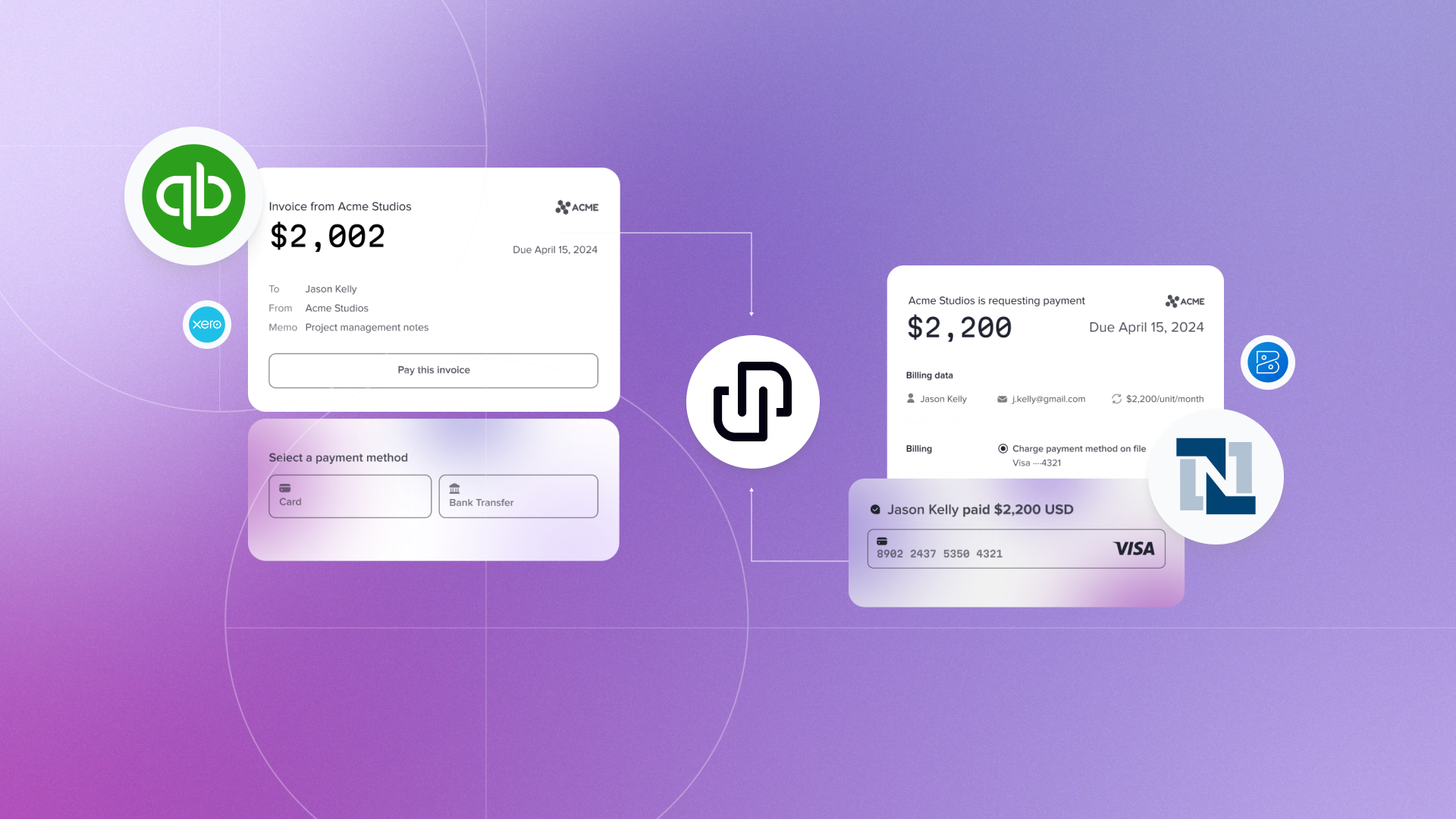

The Impact: Fintech companies gain a competitive edge through offering great customer experience

Integrating bank feeds makes your product offering that much more powerful and appealing to SMBs seeking streamlined financial operations. Advanced features like automated bank feeds set your product apart from competitors, attracting more customers and enhancing your market position.

For QuickBooks, bank feeds provide a much-needed solution for syncing bank transactions with a core accounting system.

By leveraging Rutter's Bank Feeds API, your fintech company can provide cutting-edge syncing functionality that competitors lack. This ensures your product becomes the preferred choice for customers looking for advanced automation and streamlined financial operations.

Flex put Rutter’s Bank Feeds API to work and is seeing big benefits

Flex, a prominent fintech startup, provides integrated business banking and credit cards as part of its financial platform.

Flex's customers, like others in the industry, struggled to manually enter and reconcile their Flex bank and card transactions to close their books. Now, they can rely on bank feeds to automatically sync transactions made on their Flex cards into their accounting systems for easy bookkeeping.

Using Rutter's APIs, Flex can build just one integration that enables customers to sync transactions into any accounting platform they use. Whether on QuickBooks, Sage, or NetSuite, any Flex customer can now automatically see their most recent transactions inside their ERP.

Learn how Bank Feed API works with the interactive demo below

Rutter’s offer: Enabling seamless accounting reconciliation in QuickBooks

For SMBs, creating seamless reconciliation between their accounting software and banking platforms isn’t simple, leaving a gap in their offering. Rutter aims to bridge this gap.

With our Bank Feeds API, we provide the infrastructure to build out these capabilities for the end user. With our new QuickBooks Bank Feed integration, users can seamlessly sync transactions from their bank or card accounts directly into QuickBooks.

More specifically, deploying Rutter’s Bank Feeds API now enables your customers to:

- Import Bank and Credit Card Transactions: The QuickBooks Bank Feed automatically imports transactions from various banks and credit card providers, ensuring that financial data is always up-to-date and accurate.

- Eliminate the Need for Manual Uploads: By automating this process, businesses can save time and reduce the administrative burden of manual data entry and reconciliation.

The QuickBooks Bank Feed further boosts Rutter’s Accounting API, providing an amplified solution to improve financial operations for SMBs. Our Bank Feeds API increases efficiency and enhances the accuracy and reliability of economic data, empowering businesses to make informed decisions and focus on their core activities.

Getting Started with Rutter’s Bank Feeds API

Sign up now to join the waitlist for QuickBooks Bank Feeds.

Want to learn more about Rutter’s Bank Feeds integrations? Watch our demos for NetSuite and Sage.