Overview of MCAs

Distinct from a traditional loan or equity, merchant cash advance companies came about in the 1990s to provide the business version of a consumer cash advance - up front capital based on future expected receivables, especially to businesses with limited credit history or without access to traditional financing.

Generally using limited data, MCAs need to model and determine the appropriate payback (or holdback) amounts. They see default rates that are 600% higher than loans from the Small Business Administration (SBA). Because of this, the (usually) small businesses using MCA financing are paying extremely high rates.

On top of that, MCA products are being offered everywhere - from traditional banks, specialized MCA companies, and directly from platforms that are processing payments, like Shopify Capital, Square Capital, and more.

The competitive market, challenging underwriting process, and market conditions recently caused many MCAs, such as Clearco to scale back recently.

How MCAs win with alternative data

To win in the MCA space, leading companies focus on two priorities:

- Better terms (rate, size of loan, and speed to funding)

- Creating a best-in-class experience for customers

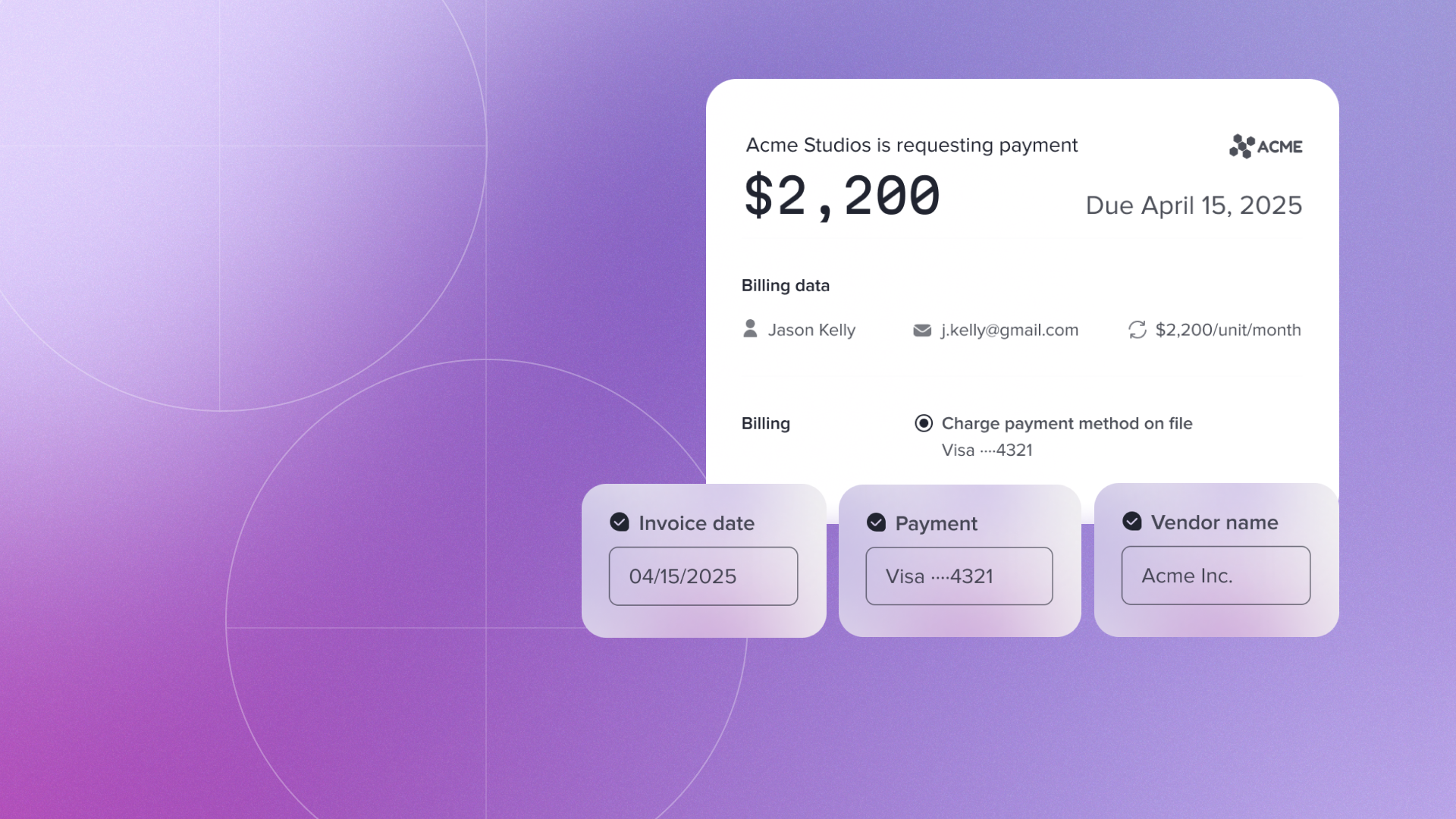

To deliver terms that win, MCAs need business financial data to underwrite. Historically, they would use bank statements for verification of sales and D&B + business credit scores - which provided a limited and often out of date view of the business. Leading MCAs have realized that to get a complete, up-to-date financial picture of a business, they need “alternative data”. Each MCA has their own proprietary underwriting approach, but they need high quality data to run through their underwriting model. The best sources of this data are from commerce (e-commerce and payment processing) and accounting platforms. For example, an embedded lender could use a real time view of sales and customer mix to make more informed decisions. See more examples here.

Secondly, to create a best-in-class experience, leading MCAs have built a streamlined online loan application process. Any friction in the process could cause potential customers to bounce off the page and seek another provider. They have to think about the tradeoff between the friction and the value of additional data, and work to make the process as simple as possible. Ideally, it should just take a few clicks to link accounting and commerce platforms.

Rutter helps leading MCA companies and fintech lenders create this front end experience for businesses and pull alternative data into the underwriting process without product teams or developers having to build out integrations into commerce, accounting, and payment processing platforms one by one.

If you’re interested in learning more about how we work with MCAs, reach out here.

Learn more about how Uncapped, a leading MCA utilized Rutter to build their integrations 5x faster and how they leverage our Universal Accounting & Commerce API.